louis vuitton tax calculator Anyway, I told her that the bags are cheaper here, but we are trying to figure out if tax is added. regardless, it will be at least $300 cheaper in london without tax. If you pay taxes . 42K Followers, 303 Following, 2,971 Posts - See Instagram photos and videos from Donut Bar - Donuts (@donutbarlv)

0 · louis vuitton bags taxable

1 · louis vuitton bag tax rate

2 · does louis vuitton pay sales tax

Louis Vuitton 【100% Original】【Box + Dust Bag】Lv Zippy Dompet Pria Panjang Presbiopia Ritsleting/Dompet Wanita Dengan Resleting Panjang/Dompet Rp 770.000 Rp 2.500.000

The amount of sales tax you’ll have to pay on a Louis Vuitton product will depend on the sales tax rate in your state. For example, if the sales tax rate in your state is 8% and .

Calculating sales tax on Louis Vuitton purchases is relatively simple. The amount of sales tax you’ll pay depends on the state and city where you’re making the purchase. To . Anyway, I told her that the bags are cheaper here, but we are trying to figure out if tax is added. regardless, it will be at least 0 cheaper in london without tax. If you pay taxes .

The answer is yes! As a luxury brand retailer, Louis Vuitton is required by law to charge sales tax on all purchases made in their stores. The amount of sales tax that you will .

Yes, Louis Vuitton products are generally subject to sales tax. However, the amount of tax varies depending on the location of purchase. In countries with a Value-Added .Unless you live in one of the no sales tax state, the U.S. MSRP are tax exclusive. Here is a real life example from my experience earlier this year (March 2022) buying a Pochette Metis in .Sales tax rate lookup and sales tax item calculator. Look up the current rate for a specific address using the same geolocation technology that powers the Avalara AvaTax rate .

Louis Vuitton is a French luxury fashion company that has been around since 1854. It was founded by designer Louis Vuitton, who had a reputation around the city of Paris to produce . When you go to the United States you have to pay sales tax if you’re buying Chanel, Louis Vuitton, Celine, Hermes or Dior Bags. This post is about how to claim sales tax .Sales Tax. Unless you live in one of the no sales tax state, the U.S. MSRP are tax exclusive Here is a real life example from my experience earlier this year (March 2022) buying a Pochette Metis in Portugal (I live in California, our sales tax is around 9.2%): At the time of purchase EUR-USD was around 1.11

LOUIS VUITTON Official USA site - Explore the World of Louis Vuitton, read our latest News, discover our Women's and Men's Collections and locate our Stores. To thoroughly check a Louis Vuitton bag or accessory and be 100% sure if a bag is real or fake, order professional Louis Vuitton authentication online for as low as . 48% of Louis Vuitton bags we authenticated last year were proven to be replicas Divide tax percentage by 100: 6.5 / 100 = 0.065. Multiply does louis vuitton charge tax online calculator price by decimal tax rate: 70 * 0.065 = 4.55. You will pay .55 in tax on a item. Add tax to list price to get total price: 70 + 4.55 = .55. How Much Will Louis Vuitton Charge for Replacing Vachetta on . The cheapest country to buy a Louis Vuitton item can vary depending on the specific product, taxes, import duties, and currency exchange rates at the time of purchase. Some countries, like France where the brand originated, may offer competitive prices, but it’s essential to research and compare prices in different regions before making a .

Receive a tax exemption form. While you are in the store, purchasing your items, you must request a tax exemption form from the seller. You should check to make sure the information entered by the store personnel is accurate, down to the spelling of your name and the house number of your home address.Louis Vuitton’s women’s small leather goods organize your key essentials in signature style. Made from the House’s historic canvases, iconic leathers or luxurious exotic skins, these accessories harmonize with the Maison’s handbag collections. Long or compact wallets add elegance to everyday transactions, alongside cardholders, passport covers and phone cases.

louis vuitton bags taxable

The Tax-free Guide to Greece: How to Get a Tax-free Refund. The 4 steps necessary in Greece to get tax back on your shopping: Choose stores that offer tax-free shopping. Have the necessary tax-free forms filled out at the store. Get your tax-free form verified by customs at the airport. Visit the airport offices of the tax refund company you . Discover how to get VAT refunds while shopping in Europe. This step-by-step guide provides valuable insights and personal experiences to help you navigate the process of obtaining VAT refunds in Europe. Learn about eligibility, minimum thresholds, the refund process, cash versus credit card refunds, and essential tips for a successful VAT refund experience. .The Tax-free Guide to Spain: How to Get a Tax-free Refund. The 4 steps necessary in Spain to get tax back on your shopping: Choose stores that offer tax-free shopping. Have the necessary tax-free forms filled out at the store. Get your tax-free form verified by customs at the airport. Visit the airport offices of the tax refund company you work . More Resources. If you are touring in Paris, see my Paris Pass vs. Paris Museum Pass comparison as a sightseeing pass does help save money for handbags.. I have also purchased a Goyard Saint Louis in Paris recently. See also Is it Cheaper to Buy Goyard in Paris and Duty-Free Hermes at the Istanbul Airport.. I also have a post about why I love my Louis .

versace keyring

These include tools that allow you to compare State taxes in different states using the same of different tax years, to calculate sales tax and more, you can find these tools under "What would you like to do today?", alternatively you can browse the full list of our US Tax Calculators here. United States Tax Calculator for 2024/25. The 2024/25 . VAT—sometimes redundantly called VAT tax—stands for value-added tax. . Louis Vuitton, Chanel—and was unable to get the instant refund at any of them.] Don’t leave the store without signed, official documents. Many department stores have a VAT office, such as Galeries Lafayette Haussmann in Paris. These offices will help you get your .

Ok, this is where it might seem complicated but it’s not, so stick with me. For sake of example, I went on today and did the same search. The Louis Vuitton Neverfull GM bag is 00 on the US website. If you add 7.5% sales tax to that, it is a little over 00.00. Are you sweating yet? Ok.

chanel flap wallet price

louis vuitton bag tax rate

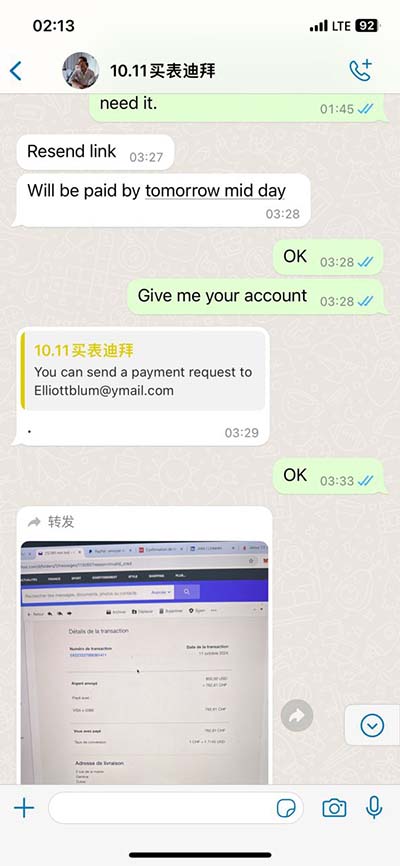

The merchant will need to create a special tax-free form for your Louis Vuitton handbag purchase. After they fill out the document, glance it over to ensure all areas are completed. 4. Get Your Documents Stamped. Your .Federal income tax breakdown. For the 2024 tax year, we estimate you will get back. The webpage provides information about the accepted payment methods for Louis Vuitton orders..00 In many countries, duty-free shops operate in tax-free zones, which means you can purchase Louis Vuitton products without having to pay any sales tax. This can result in substantial savings, especially when it comes to luxury .

Louis Vuitton is a world-renowned brand that has been creating luxury fashion items for over 160 years. The brand has become synonymous with high-end fashion and exclusivity, but many people wonder if Louis Vuitton ever sells their products at a discount.

Once you load the calculator, you can select from 12 brands (Chanel, Louis Vuitton, Hermes, Céline, Balenciaga, Gucci, Prada, Dior, Saint Laurent, Isabel Marant, Valentino and Louboutin). After choosing the brand, you can select category, product type, style and color. Once you’ve gone through all the parameters, you will see an average .Withholding Tax and Advance Tax: Calculate and process monthly withholding taxes, and ensure timely filing of withholding tax returns. Prepare and manage quarterly advance tax payments. External Consultant Management: . Louis Vuitton respecte et promeut l'égalité des chances. Nous célébrons et accueillons toutes les singularités et nous .More of a tax/travel question but someone in this group has to have some experience on this so here goes. I live in the US, but am buying a few bags for my wife while in Paris on vacation. I know I can apply for a VAT refund of 12% with Paris customs when I leave Paris, but I am unclear if I have to pay taxes on those items when I return to .

Shop S181, Level 1 Westfield Newmarket, 277 Broadway, Newmarket 1023 Auckland, NEW ZEALAND

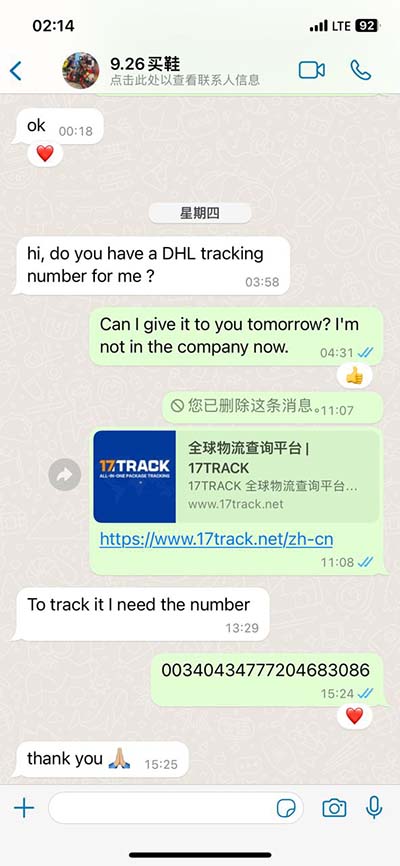

Airport/train terminals serving local eu routes like italy to paris won’t have customs or vat refund counters because it’s still considered domestic route. Inside Qatar Airways’ exclusive Doha Louis Vuitton Lounge; View All Airports . Coming soon: the best new luxury hotels opening in 2025; Still to come: the best new luxury hotels opening in 2024 . Note that for items costing AUD,000 or more, the tax invoice must include a the buyer's identity, such as their full name or passport number.

4.5.1 To ensure better service and better availability of our products, Louis Vuitton limits the quantity of products that can be purchased as follows : no more than 3 leather goods (including small leather goods) per transaction, with no more than 2 identical products per such transaction. Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles de Gaulle Airport, and indulge in duty-free shopping. Track your refund, enjoy exclusive deals, and elevate your collection with the savings. Get expert tips for a seamless tax-free shopping .

does louis vuitton pay sales tax

The best web video downloader for Windows. Download ANY Video to your PC in mere minutes. Support Hundreds Video Sites including: Youtube, HuLu, MTV, CBS. Convert ANY videos for your portable devices like iPod, iPhone, PSP, Zune, etc. devices. Conver ANY Video to FLV and put it on ANY web site.

louis vuitton tax calculator|does louis vuitton pay sales tax