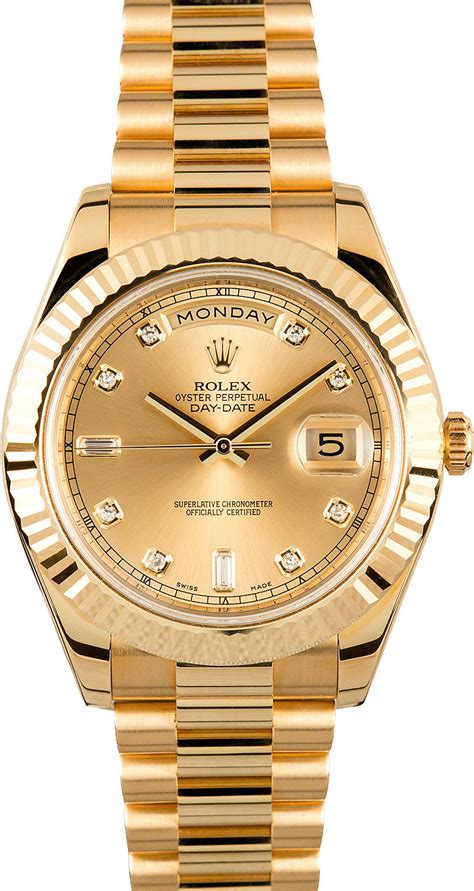

buy rolex no sales tax You should carefully check the tax laws concerning “use tax” if your state imposes . Used. New/unworn. Item is in stock. Includes Buyer Protection. European Union. North and South America. Watch with original box and original papers. to $3,400. to $5,000. from $5,000. Case material: Steel. Case material: Titanium. 42 mm. 41 mm. Dial: Black. Dial: Blue. Dial: Brown. 2020's. 2000's.

0 · sales tax on rolex watches

1 · rolex watches tax free shipping

2 · rolex sales tax laws

3 · rolex sales tax exemption

4 · rolex sales tax avoidance

5 · rolex no sales tax

6 · does rolex pay taxes

7 · do rolex watches sell tax free

4 jours à Malte. 3. 1 semaine à Malte. 4. 2 semaines à Malte. L’île de Malte est suffisamment petite pour loger à un seul endroit et découvrir chaque jour une région .

There are just five states with no state sales tax at all: Alaska, Delaware, Montana, New Hampshire and Oregon. Sadly, Authorized Rolex Dealers do not ship items and while you could visit those states and check if the official store has the model you desire, it is almost .

When returning to the US, you have tax freedom on purchases of up to 0. . You should carefully check the tax laws concerning “use tax” if your state imposes .The largest & most trusted name to buy or sell 100% certified pre-owned and used Rolex . When returning to the US, you have tax freedom on purchases of up to 0. Yet, most luxury watch purchases will be subject to a 6.5 percent duty charge, as they will cost thousands of dollars. In many cases, retailers will .

There are just five states with no state sales tax at all: Alaska, Delaware, Montana, New Hampshire and Oregon. Sadly, Authorized Rolex Dealers do not ship items and while you could visit those states and check if the official store has the model you desire, it is almost certainly going to be easier to just purchase your Rolex online. Easy . For watches priced 0-,999.99, buyers can add the Authenticity Guarantee service on qualifying items for plus applicable taxes applied at checkout per item. With eBay, you can find those.

You should carefully check the tax laws concerning “use tax” if your state imposes a sales tax. If you purchase an item in a state with lower (or no) sales tax, you owe the amount of tax difference.The best place to buy Rolex watches tax-free is in Europe. This is because of the high VAT (Value Added Tax) that the EU has. The lowest rate of VAT is 15%, but most countries have a VAT of about 20%.

The largest & most trusted name to buy or sell 100% certified pre-owned and used Rolex watches like the Submariner, Datejust, GMT, & Daytona. Best prices, best selection, Free shipping at Bob's Watches.

When returning to the US, you have tax freedom on purchases of up to 0. Yet, most luxury watch purchases will be subject to a 6.5 percent duty charge, as they will cost thousands of dollars. In many cases, retailers will provide the . I am genuinely curious why don’t more people buy watches from states that don’t have any taxes? Is there a catch to this? I’m planning to buy my first rolex and I am planning to drive to a watch dealer that’s located in a state with no tax. The most recent tax value of Rolex in the US market is 18% to 20% selling price. According to the Harmonized tariff schedule of the US, the applicable subheading for the Rolex submariner watches will be 9102.21.70 and the other one .

Where are the 10 best places to buy a cheap Rolex? You'll find the cheapest Rolex watches online, or in destinations you can claim tax back. I'm thinking of either buying the watch in another state and seeing if they will ship it to me without charging sales tax, or buying the watch at an airport duty free and then bringing it back into the U.S. There are just five states with no state sales tax at all: Alaska, Delaware, Montana, New Hampshire and Oregon. Sadly, Authorized Rolex Dealers do not ship items and while you could visit those states and check if the official store has the model you desire, it is almost certainly going to be easier to just purchase your Rolex online. Easy . For watches priced 0-,999.99, buyers can add the Authenticity Guarantee service on qualifying items for plus applicable taxes applied at checkout per item. With eBay, you can find those.

You should carefully check the tax laws concerning “use tax” if your state imposes a sales tax. If you purchase an item in a state with lower (or no) sales tax, you owe the amount of tax difference.The best place to buy Rolex watches tax-free is in Europe. This is because of the high VAT (Value Added Tax) that the EU has. The lowest rate of VAT is 15%, but most countries have a VAT of about 20%.The largest & most trusted name to buy or sell 100% certified pre-owned and used Rolex watches like the Submariner, Datejust, GMT, & Daytona. Best prices, best selection, Free shipping at Bob's Watches. When returning to the US, you have tax freedom on purchases of up to 0. Yet, most luxury watch purchases will be subject to a 6.5 percent duty charge, as they will cost thousands of dollars. In many cases, retailers will provide the .

I am genuinely curious why don’t more people buy watches from states that don’t have any taxes? Is there a catch to this? I’m planning to buy my first rolex and I am planning to drive to a watch dealer that’s located in a state with no tax. The most recent tax value of Rolex in the US market is 18% to 20% selling price. According to the Harmonized tariff schedule of the US, the applicable subheading for the Rolex submariner watches will be 9102.21.70 and the other one .

Where are the 10 best places to buy a cheap Rolex? You'll find the cheapest Rolex watches online, or in destinations you can claim tax back.

sales tax on rolex watches

fake hublot hong kong

$639,900. Hide. Favourite. 1504 - 10 MALTA AVENUE. Brampton, Ontario L6Y4G6. MLS ® Number: W8163982. 3 + 1. Bedrooms. 2. Bathrooms. - Square Feet. Highlights. Neighbourhood. Statistics. Calculators. Listing Description. Very clean 3 bedrooms end unit condo in Brampton for sale. 2 full washrooms, primary bedroom has another separate .

buy rolex no sales tax|rolex sales tax avoidance