lvmh profit margin Profit from recurring operations stood at €22.8 billion for 2023, up 8%. The current operating margin remained stable with respect to 2022. Group share of net profit amounted to . #louisvuitton #lvshoes #lvmh 00:00 - Intro00:10 - The visible logos and stitching00:59 - The tongue logo01:32 - The outsole02:08 - The inside tag03:02 - The .

0 · lvmh revenue 2022

1 · lvmh revenue

2 · lvmh performance 2022

3 · lvmh investments

4 · lvmh dividends 2022

5 · lvmh company

6 · investors lvmh

7 · gross margin of lvmh

Falcon IV is an endophyte enhanced tall fescue with >92% Neotyphodium coenophialum endophyte which provides resistance to a number of leaf and crown feeding insects and nematodes. The presence of endophyte also contribute to improved biotic and abiotic stress tolerance, faster seedling establishment, enhanced fall recovery and reduced summer .

lvmh revenue 2022

rolex cheap price

Profit from recurring operations stood at €21.1 billion for 2022, up 23%. Operating margin remained at the same level as 2021. Group share of net profit was €14.1 billion, up 17% compared to 2021. Operating free cash flow surpassed €10 billion.Profit from recurring operations stood at €22.8 billion for 2023, up 8%. The .Key figures. LVMH’s long-term success depends not only on the Group’s solid . Profit from recurring operations stood at €22.8 billion for 2023, up 8%. The current operating margin remained stable with respect to 2022. Group share of net profit amounted to .

Key figures. LVMH’s long-term success depends not only on the Group’s solid business model and profitable growth strategy, but also on its unwavering commitment to creativity, .

In 2023, LVMH had a gross margin of 59.3 billion euros. The LVMH Group is a French luxury goods corporation, which owns 75 luxury brands worldwide, including Louis Vuitton, Moët, Hennessy,. Profit from recurring operations stood at €21.1 billion for 2022, up 23%. Operating margin remained at the same level as 2021. Group share of net profit was €14.1 billion, up 17% . Profit from recurring operations stood at €22.8 billion for 2023, up 8%. The current operating margin remained stable with respect to 2022. Group share of net profit amounted to . Global gross profit of LVMH from 2017 to 2023. Gross margin of the LVMH Group worldwide from 2017 to 2023 (in million euros)

We are maintaining our fair value estimate of EUR 670 per share for wide-moat LVMH as the company reported solid 2023 results, just slightly ahead of our estimates. .

LVMH Moet Hennessy Louis Vuitton SE balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. View LVMHF financial statements in full. Profit from recurring operations for the first half of 2024 came to €10.7 billion, equating to an operating margin of 25.6%, significantly exceeding pre-Covid levels. Exchange . LVMH seeks to boost the profit margins for each of its business groups through a rather strategic approach to mergers and acquisitions. Over the past decade, the Watches & Jewelry business group .

lvmh revenue

La réussite à long terme de LVMH repose autant sur la solidité de son modèle économique et de sa stratégie de croissance rentable que sur la permanence de ses engagements au service de la créativité, de l’excellence et de son empreinte environnementale et citoyenne. . PROFIT FROM RECURRING OPERATIONS; INCOME STATEMENT. In millions . Profit from recurring operations for the first half of 2024 came to €10.7 billion, equating to an operating margin of 25.6%, significantly exceeding pre-Covid levels. Exchange rate fluctuations had a substantial negative impact on the half-year period. The Group share of net profit amounted to €7.3 billion.Net profit margin can be defined as net Income as a portion of total sales revenue. Louis Vuitton net profit margin for the three months ending June 30, 2023 was . Stock Screener . Stock Research . LVMH Moet Hennessy Louis Vuitton is an international group of companies that is principally engaged in the production and sale of prestigious .Committed to positive impact, LVMH actively supports social, environmental and cultural initiatives with a long-term vision, in order to make a lasting difference. The Group works closely with numerous stakeholders that address important social issues. Our commitment in action; For People; For the Environment; For Philanthropy;

Committed to positive impact, LVMH actively supports social, environmental and cultural initiatives with a long-term vision, in order to make a lasting difference. The Group works closely with numerous stakeholders that address important social issues.

be seen in the year-on-year changes of profit margin and operating profit, which indicate that LVMH's profitability is stable but rising. From the perspective of LVMH's accounts receivable . LVMH has seen a decline in valuation, but offers significant safety, growth potential, and upside with an AA credit rating. Find out why LVMHF stock is a Buy. . I understand their profit margins .

Profit from recurring operations stood at €21.1 billion for 2022, up 23%. Operating margin remained at the same level as 2021. Group share of net profit was €14.1 billion, up 17% compared to 2021.Operating Margin for LVMH (MC.PA) Operating Margin at the end of 2023: 25.10%. According to LVMH's latest financial reports and stock price the company's current Operating Margin is 25.10%. . The operating margin is a key indicator to assess the profitability of a company. Higher operating margins are generaly better as they show that a .For LVMH profitability analysis, we use financial ratios and fundamental drivers that measure the ability of LVMH to generate income relative to revenue, assets, operating costs, and current equity. These fundamental indicators attest to how well LVMH utilizes its assets to generate profit and value for its shareholders.Operating Margin for LVMH (MC.PA) Operating Margin at the end of 2023: 25.10%. According to LVMH's latest financial reports and stock price the company's current Operating Margin is 25.10%. . The operating margin is a key indicator to assess the profitability of a company. Higher operating margins are generaly better as they show that a .

LVMH Moët Hennessy Louis Vuitton SE, commonly known as LVMH, is a multinational conglomerate headquartered in Paris, France. . - Profit Margins: The company’s focus on high-margin luxury .In depth view into Lvmh Moet Hennessy Louis Vuitton Profit Margin including historical data from 2008, charts and stats. . Lvmh Moet Hennessy Louis Vuitton Profit Margin. Profit Margin Chart. View Profit Margin for LVMUY. Upgrade now. Sep '18. Jan '19. May '19 . 285.00. 270.00. 255.00. 240.00.

5 Europe Equity Research 28 July 2020 Melanie Flouquet, ACA (39-02) 8895-2133 [email protected] H1 20 Profit in focus LVMH H1 20 profit from recurring operations came in well short of analysts’ expectations and JPMe despite the 4% beat on Sales. Profit from recurring operations came in down 62% yoy to €1,671m vs JPMe €2,290m or EBIT .For LVMH profitability analysis, we use financial ratios and fundamental drivers that measure the ability of LVMH to generate income relative to revenue, assets, operating costs, and current equity. These fundamental indicators attest to how well LVMH utilizes its assets to generate profit and value for its shareholders. Finally, true to form as a luxury fashion biggie, LVMH's margins remain rather strong even now. The recurring operations profit margin came in at 25.6%, even as it saw a softening from the even .LVMH Moet Hennessy Louis Vuitton SA ADR's latest twelve months gross profit margin is 68.5%.. View LVMH Moet Hennessy Louis Vuitton SA ADR's Gross Profit Margin trends, charts, and more.

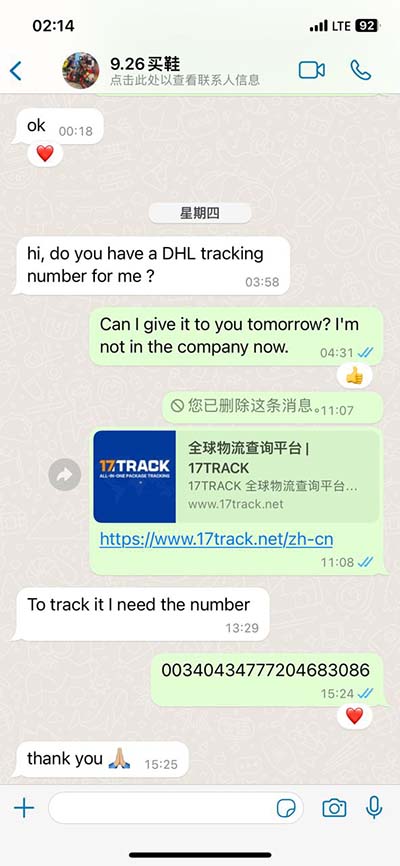

Professional Louis Vuitton authenticators say that the #1 way to spot a fake bag is to check the label stitched on the inside. It is never correctly replicated, according to our Expert LV Bag Authenticators. 1. Interior label. Authentic: Thicker text, with all letters placed at the same level. Fake: Text is too thin and the letters are misplaced.

lvmh profit margin|lvmh dividends 2022