chanel paris tax refund By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a . A blend of human and machine, the Cyborg uses their cybernetic enhancements in battle, merging intellect with advanced technology. Details. Cyborg is a playable class in Tiny Rogues. Game Mechanics. Cyborg is always offered at least one cybernetic augment trait. A full list of Cyborg's cybernetic augment traits can be found here. Tips Trivia .

0 · tax free stores in paris

1 · paris luxury tax free shopping

2 · paris luxury tax free department

3 · louis vuitton france tax refund

4 · chanel va tax refund

5 · chanel louis vuitton tax refund

6 · chanel goyard vat refund

7 · chanel france tax refund

SKU: SOA748V0300. Other Names: Automatic Continuously Variable Transmission (CVT) Fluid. Condition: New. Sold In Quantity: 1. Subaru Parts Quick. You can get your High Torque CVTF LV (5 GA (soa748v0300) right on your door step in just a matter of days when you order with us online.

Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles de Gaulle Airport, and indulge in duty-free shopping.This is me in Madeira, Portugal. In my website i teach you how to get to unforgettable spots l.

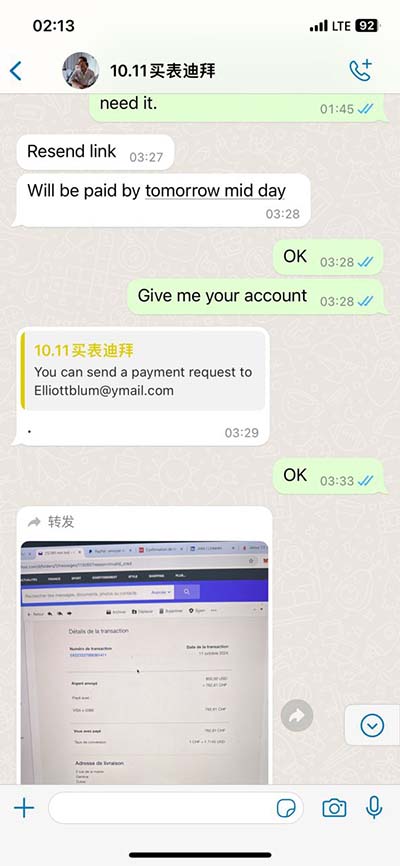

Currently the vat rate is 20%, which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your first Chanel bag in Paris, that VAT return will be . In France, there’s two major companies that processes VAT refunds for retailers: Global Blue and Planet Tax Free (formally Premier Tax Free). In my experience, Global Blue .By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a . Immediate Refund: Visit the tax refund desk at the airport, port, or train station for an on-the-spot refund. Alternatively, mail your documents to a tax refund office like Detaxe SAS or Global Blue France for processing.

tax free stores in paris

Understanding the VAT tax refund process in Paris, France. What is the refund amount, how do you process the paperwork, and who qualifies for the VAT refund? In general, Chanel offers a 12% tax refund on their products. This means that if you spend €1,000 on Chanel products in Paris, you’ll receive a €120 refund. How to claim your . For purchase made in Chanel boutiques, tax refund (via credit card) will be done in the boutiques so I do not need to go through the tax refund procedure at the CDG airport? .

reloj gucci mujer

Tax are included in the price, and you’ll get 12% back for VAT refund. However, it will just make the Paris prices slightly cheaper than the US, not a lot of saving because the price in Euro is . Refunds are given for simultaneous purchases (purchases made at one time, at one location) which exceed approximately 170€. In all cases, merchandise for which a VAT .I got a Chanel bag during this recent trip. The tax refund percentage is about 13% but I was only able to get 10% (which is still better than nothing). I think charges included: Detaxé company service charge, customs fee and still a teeny tiny bit of tax to France. Even as a luxury brand, it’s on the pricier end, so buying in Paris makes even more sense. The timeless 2.55 bag with its quilted black leather and elegant gold chain shoulder strap goes for ,200 in the US. In Paris, you .

paris luxury tax free shopping

Today I'm showing you what I purchased in Paris AND explaining how the VAT Refund works! When luxury shopping in Paris, or just shopping in Europe, from high.Shops in Paris offering tax refund: > Top luxury brands like Louis Vuitton, Chanel, Hermès. > Fnac shops in Paris: Fnac des Halles, Fnac des Ternes, Fnac Saint Lazare > La Maison .Kate Lee, creator of unique models of trendy and timeless women's bags and leather goods in . So for any of you dreaming about buying your first Chanel bag in Paris, that VAT return will be significant. Here’s how to make sure you get it! Paris VAT Refund Qualifications. An item must be new and unused in order to be VAT refund eligible. This means you should avoid wearing those shiny new Italian leather shoes until you get back home.

The Cash Paris offices allow you to carry out your tax refund operations. You can obtain an immediate refund in cash in euros, on your electronic wallet (e-wallet) or a deferred refund on your bank card for any French or international slip previously validated with customs located before the security checks. at Paris-Orly airport:Which products are eligible for the Tax Refund ? Purchases over €100 made at Galeries Lafayette (Main Building, Men’s Department, Home & Food Department “Gourmet”, and Shopping and Welcome Center stores ).; The Tax Refund form must be completed within three consecutive days of purchase and original receipts must be attached; Purchases must be for personal use .

Answer 1 of 8: Hi! I'm getting my friend to purchase the Chanel bag in Paris. However, I am getting a bit confusing over the tax refund there and I do not want my friend to have a hard time with the tax refund while in Paris. For purchase made in Chanel. A recap on tax refunds. There are two main steps to getting a VAT refund on shopping: Get a refund form. Validate your refund form. Getting a refund form. There are two main ways you can get a tax refund form – using the traditional, in-store paper method, or a digital app like Wevat.

For instance, if you purchase your Chanel handbag in Paris and apply in London, you will get the tax-refund amount for Paris. Affiliate companies will help you process this information properly so you receive the right VAT percentage for your goods. Step By Step: The Tax-refund Process. So how exactly does one go about acquiring their tax .

Instead of the traditional 12% VAT Tax Refund back on items in France using the pen and paper method, you received 13.4% Vat Refund back using the New Wevat Digital Tax Refund process. For example, if you buy a Hermes bag for 5000 Euros, you will receive 670 Euros back instead of .

The combination of favorable exchange rates and the potential for tax refunds can make buying a Chanel bag in Paris significantly more budget-friendly than in other places. . but in Dubai you get only 3% tax-refund, while in Paris you can get as much as 12% tax-refund. Here are the retail prices of Chanel Medium Classic Flap Bag in both .

I’ve read online that you’re supposed to get 20% back but the tax refund companies that process the paperwork for you actually takes a cut. In the end, you end up getting 12% back or at least that is what the paperwork always says. . VAT Refund in France Examples Example #1: Chanel Coco Crush Ring. . Cost in Paris: 2,800 euros; Cost in . Is Chanel Tax-Free at Heathrow Airport? Since January 2021, the tax-free program has ended in the UK. . The Chanel Medium Classic Bag in Paris is priced at €8536 euros (VAT excluded). So you save €1164 euros if you buy in Paris or other European countries. . Here’s a note from Global blue tax-refund company:The third reason Chanel is more affordable in Paris is because of the currency exchange rate. Over the last 5–10 years the EURO has been slowing going down in value while the dollar is slowly getting stronger. The fourth and final reason . For example, if we look at Louis Vuitton’s Pochette Metis, the price is currently €2,050 (,250) in France, £1,830 in the UK (,235), and ,570 (+tax) in the US. 2. VAT Refunds. The second reason why prices are usually .

richard mille persona

Chanel Tax-Refund in France. You can get tax-refund for Chanel items in France. The VAT rate is 20% in France. Is Chanel bag cheaper in Paris? Yes, Chanel Bags are cheaper in Paris. And if you can get tax-refund, then .Answer 1 of 8: Hi! I'm getting my friend to purchase the Chanel bag in Paris. However, I am getting a bit confusing over the tax refund there and I do not want my friend to have a hard time with the tax refund while in Paris. For purchase made in Chanel.

Getting a TAX Refund in Europe. When it comes to tax refunds, every European country has its own amount of VAT percentage. The highest tax refund available in Europe is from the Netherlands, which offers a huge 21% tax .

Occasionally, stores can process a refund for you on site (called “instant refund”), but most use Global Blue, Premier TaxFree, or another third-party to handle the refund process. [Author’s note: I shopped at some of the largest stores in Paris—Le Bon Marché, Liberty, Louis Vuitton, Chanel—and was unable to get the instant refund at . European Union citizens who now live permanently in a non-EU country may access a VAT refund at departure from Italy. How do you get a VAT refund in Italy?³ Receive a tax exemption form. While you are in the store, purchasing your items, you must request a tax exemption form from the seller. How much is tax-refund in Paris? France's refund rate is 12% of purchase amount, with a minimum purchase amount of 175.01 EUR per receipt. Pharmacy goods, food and books have reduced VAT rates. Cash refund rate for Premier Tax Free is around 10.8%. You need to be older than 16 and have permanent residence in a non-EU country to be eligible.

paris luxury tax free department

The highest tax refund available in Europe is from the Netherlands, which offers a huge 21% tax refund. Meanwhile, Switzerland only offers 8%. It is therefore vital that you check the tax refund percentage of the country you intend to travel to prior to making your Chanel purchase as this will impact the overall cost.Chanel Handbag in Paris. Do you receive the tax refund on luxury goods in Paris? The great news is that if you spend over 100.01 Euros you’re entitled to the tax refund process in Paris. The tax refund includes luxury goods! Most of the time the sales associate will automatically fill your paperwork, but in case they don’t make sure you ask!

Addresses: 3 Locations: 45, avenue Bosquet 75007 Paris; 6, place Moro-Giafferi 75014 Paris; 84, avenue Mozart 75016 Paris. VAT Tax Refund on Vintage Luxury Shopping. When shopping for Vintage luxury goods in Paris, you qualify for the VAT Tax refund. The VAT Tax refund is a tax that locals pay that as a tourist you don’t have to pay. Any missing documents will result in the tax refund being denied. Have the forms validated. When you arrive at the airport, present your passport, original purchase invoice, tax refund declaration form, and the items you purchased at Customs for inspection and stamping of the tax refund confirmation. Obtain a VAT refund. Now, you can head to . Discover how to get VAT refunds while shopping in Europe. This step-by-step guide provides valuable insights and personal experiences to help you navigate the process of obtaining VAT refunds in Europe. Learn about eligibility, minimum thresholds, the refund process, cash versus credit card refunds, and essential tips for a successful VAT refund .

zapatos gucci mujer plataforma

lv senayan city

letter. d, letter that has retained the fourth place in the alphabet from the earliest point at which it appears in history. It corresponds to Semitic daleth and Greek delta (Δ). The form is thought to derive from an early pictograph, possibly Egyptian, indicating the .

chanel paris tax refund|louis vuitton france tax refund